All Categories

Featured

Table of Contents

Home mortgage life insurance coverage provides near-universal insurance coverage with very little underwriting. There is typically no medical exam or blood sample needed and can be a useful insurance policy choice for any kind of home owner with major pre-existing medical problems which, would stop them from buying traditional life insurance policy. Various other benefits include: With a mortgage life insurance policy in position, successors won't have to fret or wonder what might take place to the family home.

With the mortgage paid off, the family members will constantly have a place to live, given they can pay for the property tax obligations and insurance policy each year. best mortgage insurance canada.

There are a few different kinds of home loan protection insurance, these include:: as you pay even more off your home mortgage, the quantity that the policy covers reduces according to the impressive balance of your home loan. It is the most typical and the cheapest type of home loan protection - mortgage life and disability protection plan.: the amount insured and the costs you pay stays level

This will settle the home loan and any kind of remaining equilibrium will go to your estate.: if you desire to, you can add serious ailment cover to your home mortgage protection policy. This implies your mortgage will be removed not just if you pass away, but also if you are detected with a serious health problem that is covered by your policy.

Ppi Insurance Companies

In addition, if there is a balance remaining after the home mortgage is removed, this will certainly most likely to your estate. If you transform your mortgage, there are several points to think about, depending upon whether you are covering up or expanding your home mortgage, switching, or paying the home mortgage off early. If you are topping up your home loan, you require to ensure that your policy satisfies the brand-new value of your home mortgage.

:max_bytes(150000):strip_icc()/insurance_final-636cb6bc31de489f836f16f029289faf.jpg)

Compare the prices and advantages of both alternatives (house buyers protection insurance). It may be less expensive to keep your original home mortgage security plan and after that purchase a second plan for the top-up amount. Whether you are covering up your home loan or expanding the term and require to obtain a new policy, you may locate that your costs is more than the last time you took out cover

What Is Mortgage Protection Insurance

When switching your home mortgage, you can assign your mortgage security to the new lending institution. The costs and degree of cover will be the same as before if the amount you borrow, and the regard to your mortgage does not transform. If you have a policy with your lender's team system, your lender will certainly cancel the policy when you switch your home mortgage.

In The golden state, mortgage protection insurance covers the whole exceptional balance of your funding. The fatality benefit is an amount equivalent to the balance of your mortgage at the time of your death.

Mortgage Payment Protection Insurance Comparison

It's necessary to recognize that the fatality advantage is provided straight to your financial institution, not your loved ones. This ensures that the remaining debt is paid completely and that your liked ones are saved the economic pressure. Mortgage security insurance can additionally give temporary insurance coverage if you end up being handicapped for a prolonged period (normally six months to a year).

There are many advantages to getting a mortgage protection insurance coverage in The golden state. A few of the leading advantages include: Ensured authorization: Also if you remain in poor health or operate in a harmful occupation, there is assured authorization without any medical tests or lab examinations. The exact same isn't true permanently insurance coverage.

Special needs defense: As specified over, some MPI plans make a couple of home loan payments if you end up being disabled and can not generate the same revenue you were accustomed to. It is necessary to keep in mind that MPI, PMI, and MIP are all different kinds of insurance policy. Home loan protection insurance (MPI) is created to pay off a mortgage in case of your death.

House Mortgage Insurance

You can also apply online in mins and have your plan in location within the exact same day. For more details regarding getting MPI protection for your home loan, call Pronto Insurance today! Our knowledgeable representatives are right here to address any concerns you might have and offer further support.

MPI provides numerous benefits, such as tranquility of mind and streamlined credentials processes. The fatality benefit is directly paid to the loan provider, which restricts adaptability - best life mortgage. Additionally, the advantage quantity decreases over time, and MPI can be much more pricey than conventional term life insurance plans.

Do I Have To Get Mortgage Insurance

Get in standard details regarding yourself and your home mortgage, and we'll compare rates from different insurance companies. We'll also show you just how much protection you require to safeguard your home mortgage.

The major advantage here is clearness and confidence in your decision, knowing you have a plan that fits your needs. Once you authorize the strategy, we'll take care of all the documents and setup, guaranteeing a smooth application procedure. The favorable result is the comfort that includes recognizing your family is secured and your home is protected, whatever occurs.

Professional Advice: Guidance from skilled professionals in insurance policy and annuities. Hassle-Free Setup: We take care of all the documentation and implementation. Cost-efficient Solutions: Finding the ideal protection at the most affordable possible cost.: MPI specifically covers your home loan, supplying an extra layer of protection.: We work to find the most economical options tailored to your budget plan.

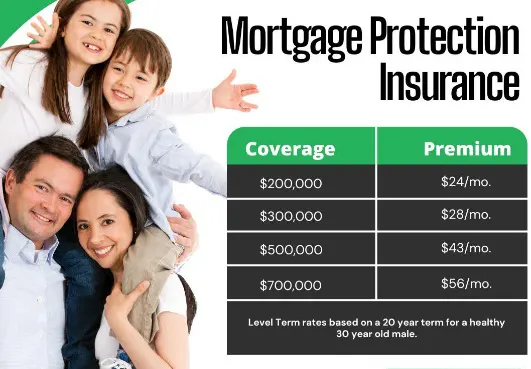

They can supply info on the protection and advantages that you have. Usually, a healthy individual can expect to pay around $50 to $100 per month for mortgage life insurance policy. However, it's advised to get a personalized home mortgage life insurance quote to obtain a precise price quote based upon specific scenarios.

Latest Posts

Senior Final Expense Insurance

Cheap Final Expense Life Insurance

Burial Insurance Policy